Learn how you can budget right and use CadRemit to get more value for your money.

Leaving home to start fresh abroad is a reality many have fantasised about. But living in Canada, the United States, or Europe means having to stretch your money further than you’ll usually do. Plus, there’s the responsibility to support loved ones back home, which can feel overwhelming. With the right approach, it’s possible to manage both your new life abroad and your family’s needs without losing control of your budget.

The double responsibility of living abroad.

When you first arrive in a new country, it’s easy to overlook how different the financial system is. For example, if you move from Nigeria to a place like Vancouver, rent may take up half your income. Another thing is that groceries can be more expensive compared to a city like Lagos. On top of that, there are hidden costs like insurance or winter clothing.

With all these, you might also have to support your family that depends on you for their education or emergencies.

This double responsibility creates pressure. It means you no longer budget just for yourself, but work to support two households. Without a budget, you can burn out or even fall into debt.

Understanding the cost of living abroad.

The first step in creating a sustainable budget is understanding the real cost of living where you are. Here is how you can break down the essentials:

- Housing: Rent or mortgage will likely be your biggest expense. However, you must understand that location is important. The cost of living in the UK versus Canada won’t be the same. In popular places like Vancouver or London, housing costs are much higher than in smaller towns.

- Utilities and transport: Bills like electricity and heating can take a large part of your income. Owning a car can double or triple those costs.

- Groceries and food: Eating out regularly abroad is far more expensive than in Nigeria. Cooking at home is a budget-saver.

- Healthcare and insurance: In the United States, healthcare is something that can be confusing at first. So, you have to plan ahead. In Europe and Canada, public systems ease the cost.

Setting clear financial priorities.

It’s tempting to send money home whenever family asks, but that can leave you struggling with bills abroad. Instead, set clear priorities:

- Cover your local expenses first. If you can’t pay your rent or utilities, you risk losing your stability.

- Create a fixed monthly amount for remittances. Instead of sending random amounts, decide what you can afford consistently. For example, if you earn $5k, you can decide 5% will be for sending back to the family in Nigeria.

- Build an emergency buffer. Life abroad comes with unexpected costs, from job loss to medical bills. Even saving a little monthly adds protection.

Using tools to stay in control.

Budgeting is easier when you use the right tools. For example, you can decide to track how much you spend in a month. Apparently, you might even be surprised at the amount of money you are wasting. Also, you can get apps that will alert you when you overspend. But beyond tracking, the biggest tool for Nigerians abroad is how they send money.

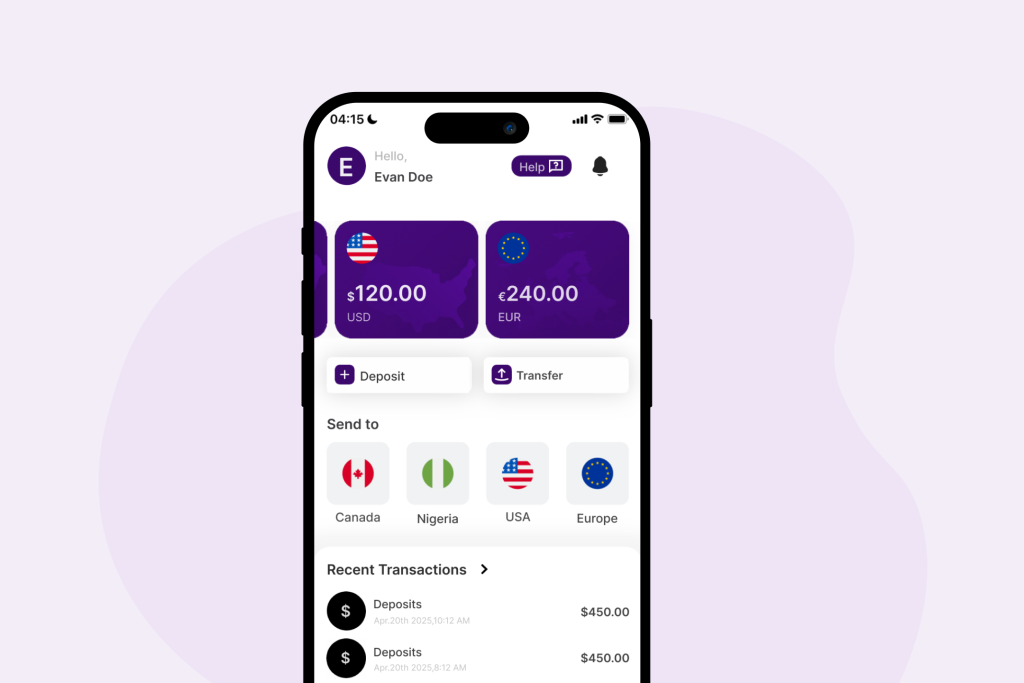

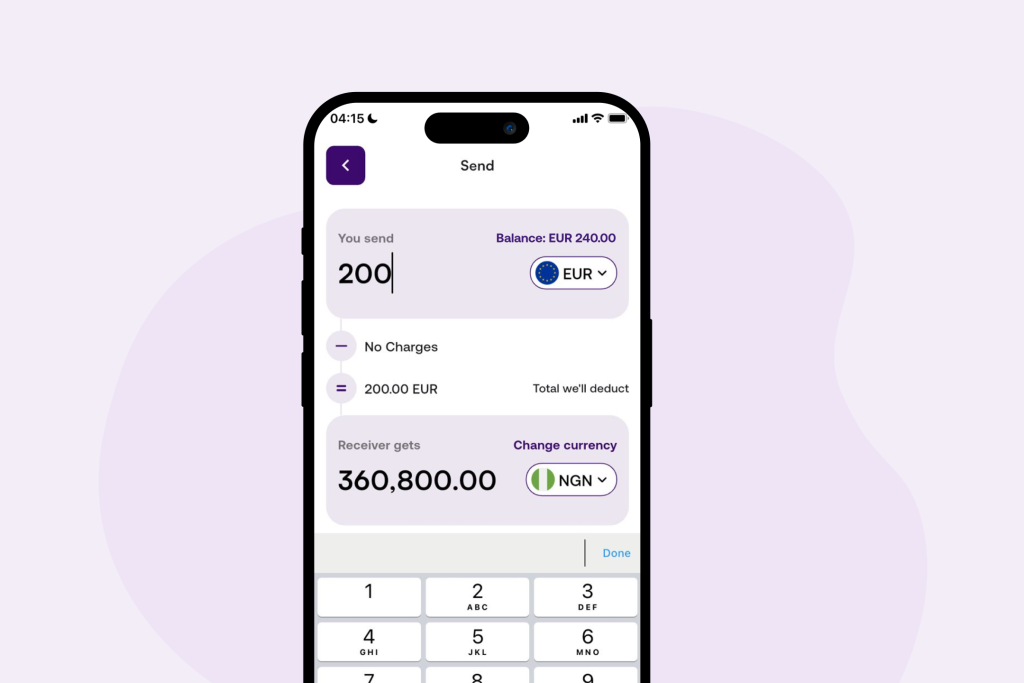

This is where CadRemit becomes important. With CadRemit’s app, you send money in a simple and reliable way. Transfers are transparent, with no hidden fees or surprises. The built-in converter shows exactly how much your naira, dollars, euros, or Canadian dollars are worth before you send.

Why the exchange rate is everything.

If you’ve ever sent money through a bank or older remittance service, you know the pain of poor exchange rates. A difference of ₦20 per dollar may not seem like much on paper, but on ₦500,000 transfers, it’s a serious loss.

CadRemit gives you the best exchange rates for transfers from Canada, Europe, and the US to Nigeria, which can help you budget better because you know exactly how much of your money is going back home.

Balancing short-term and long-term needs.

While it’s natural to focus on immediate needs, you probably should not forget the long term. Saving for retirement or building assets abroad ensures you won’t always be stretched thin. You can also plan for the long term by saving or building a side business. Over time, this can reduce your reliance on a single job and give you more stability abroad.

Common mistakes to avoid.

- Sending more than you can afford: Generosity is admirable, but it shouldn’t leave you unable to meet your obligations.

- Don’t ignore exchange rates. Even small differences add up, so always check before sending.

- What you don’t measure, is something you can’t manage. So track your expenses.

- Stop over-relying on credit. Don’t use loans or credit cards to fund family support because it can create long-term financial stress. But for investments, credit can work.

Living abroad while supporting family at home is something that requires you to have a balance. So, it is very important that you understand your expenses and use the right tools to manage them.

Living abroad while supporting family at home is something that requires you to have a balance. So, it is very important that you understand your expenses and use the right tools to manage them.