This is how freelancers in Canada can receive USD payments with CadRemit.

Imagine this: You’re a freelancer in Canada who works with U.S. clients, and you expect things to be straightforward when it comes to getting paid. You complete a project, send your invoice, wait for the payment, and get paid, right? But once the money arrives, you may learn that you’ve received much less than expected.

That drop in your earnings usually comes from automatic conversions, bank fees, and unfavorable exchange rates. Over time, these small losses can take a noticeable share of your income.

If you rely on USD payments, understanding your options can help you get the value of your money. This guide explains some ways you can receive USD in Canada and keep more of what you earn.

Why Bank Conversions Reduce Your Earnings

Most Canadian banks convert USD into CAD as soon as payments arrive. You don’t get to choose when the conversion happens. You also don’t control the exchange rate.

That means:

- You receive the rate the bank decides

- You may pay additional conversion charges

- You lose some of your income immediately

If you work with U.S. clients regularly, managing these costs is important.

Options For Receiving USD Payments in Canada

You have several choices when it comes to getting paid in USD. Each one works differently and affects how much you keep.

Option 1: USD Account at a Canadian Bank

A USD account allows you to:

- Receive and hold U.S. dollars

- Decide when to convert into CAD

- Avoid instant conversion losses

However:

- Wire transfer fees may apply

- Transfers can be slow

- Not always the most flexible option for freelancers

This method works, but it may not be the most cost-efficient.

Option 2: Payment Platforms

Tools like PayPal, Wise, and Payoneer allow you to:

- Invoice clients digitally

- Receive USD directly

- Transfer money to your bank later

They offer convenience, but you may face:

- Service fees per payment

- Platform-specific exchange rates

- Payout delays when moving money to a bank

These platforms can be helpful, but costs vary based on your transaction volume.

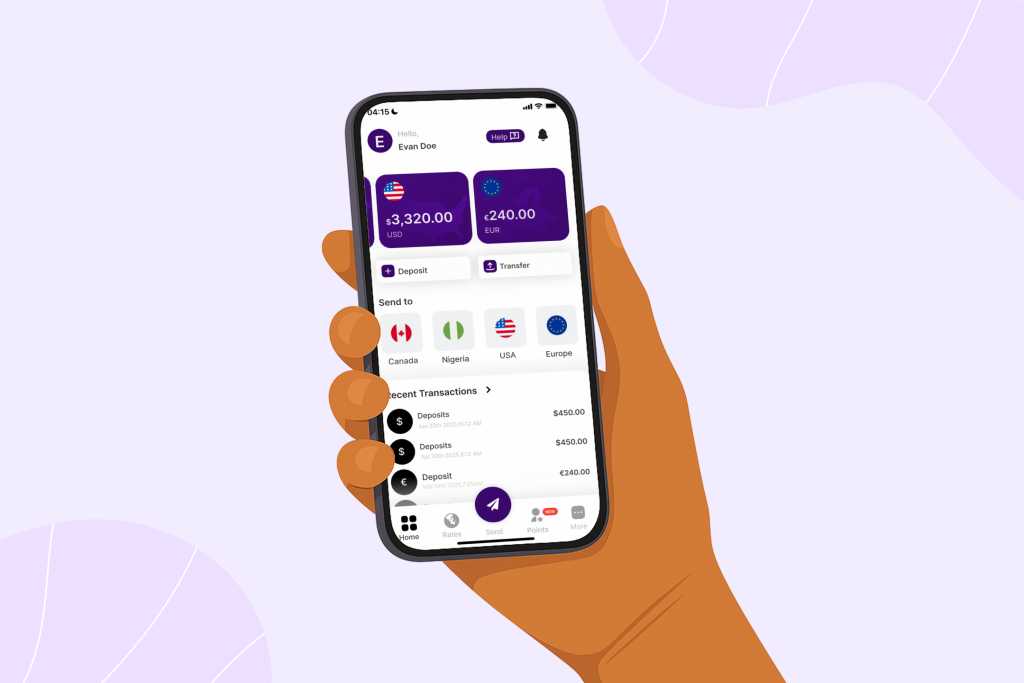

Option 3: Virtual USD Accounts

Virtual accounts provide a better way to receive USD from U.S. clients through standard account details such as routing and account numbers. Payments arrive without forced conversion.

You can then:

- Hold USD

- Convert at a time that benefits you

- Track the value before exchanging

This gives freelancers more control over earnings and helps reduce surprises when converting to CAD.

CadRemit offers virtual USD accounts for eligible residents, giving you a direct way to manage USD income alongside other currencies.

Why Exchange Rates Matter

Even a small difference in exchange rates can impact your income. For example, converting a few thousand dollars at a weaker rate can noticeably reduce your yearly earnings.

Platforms that display live exchange rates help you convert when the value works in your favor. You always know the amount before confirming the exchange.

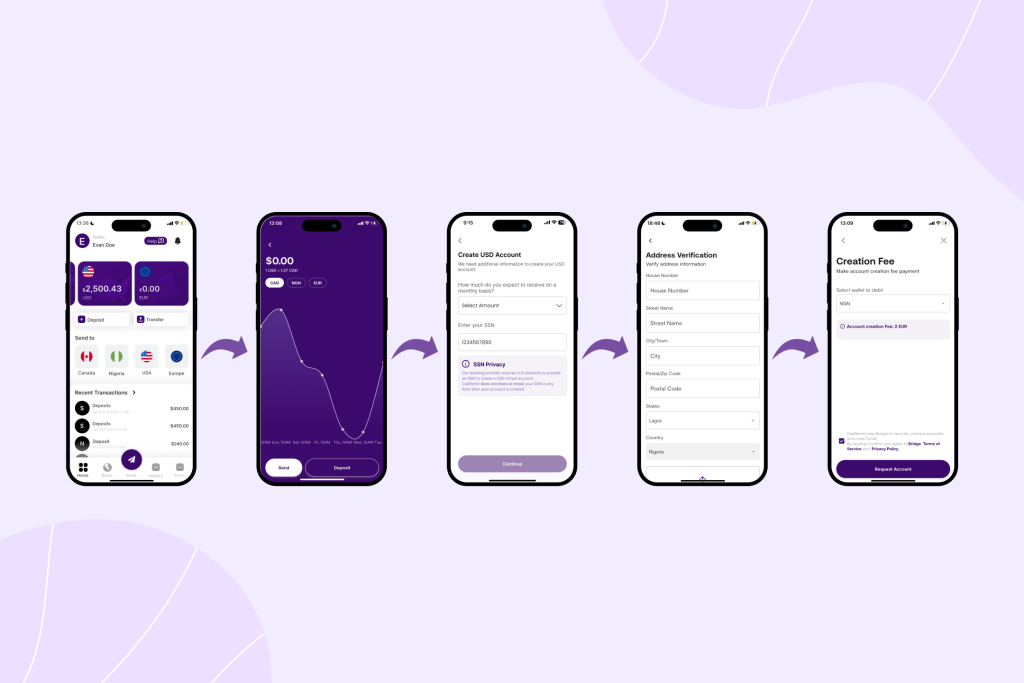

How To Set Up Your USD Virtual Account

Here is a simple process to follow:

- Sign in to your CadRemit app.

- Tap Deposit.

- Tap USD, then tap Continue.

- Add your primary purpose, sending platform, and estimated monthly transaction volume, then tap Continue.

- Choose your preferred funding wallet, whether EUR, CAD, or NGN, and tap Request Account.

Additionally, please note: A $3 account creation fee applies when setting up your USD virtual account.

Freelancing Tips For Managing Multiple Currencies

A few small practices can protect more of your earnings:

- Invoice only in USD when working with U.S. clients

- Monitor deductions and track fees

- Convert funds in larger amounts when rates are favorable

These adjustments make a long-term difference.

When Clients Have Their Own Preferred Method

Sometimes, clients prefer to pay using their usual platform or bank service. You can offer options while still keeping your payment strategy intact.

For example, you can:

- Receive payments in USD

- Convert only the part you need for Canadian expenses

- Use the rest for savings or international transfers

A flexible setup helps you meet client expectations without losing value.

With the right setup, you can reduce conversion losses, gain better visibility into exchange rates, and access your money when you need it.

Keeping more of what you earn starts with choosing what works for you. If you want more control over USD payments, explore virtual account options from CadRemit.