Learn how currency devaluation affects your cross-border transfers

If you have ever sent money abroad, you will notice that sometimes your recipient gets less than expected. Situations like that are the effects of what is called currency devaluation. Let’s break it down so you understand what it is all about.

What Is Currency Devaluation?

Currency devaluation happens when a country’s central bank intentionally lowers the value of its currency compared to others. Some countries do this to boost exports or manage national debt. When a currency is devalued, it becomes weaker. In other words, it takes more of that currency to buy one another.

For example, if $1 equals ₦1,400 today and ₦1,500 next month, the naira has been devalued. It now takes more naira to buy one dollar. The same logic applies anywhere, from the UK to Canada.

Why Do Governments Devalue Their Currencies?

Countries intentionally lower the value of their currency for several reasons:

- To increase exports: A weaker currency makes local goods cheaper for foreign buyers.

- To reduce trade deficit: Cheaper exports can bring in more foreign currency. So, it helps them balance the books.

To manage national debt: If a country owes money in its own currency, devaluation makes it easier to repay.

According to some experts, the devaluation of a currency affects the citizens of a country, too. Especially if you’re sending or receiving money across borders. That means they will have to pay more to send money to their family or business partners.

How Does Devaluation Affect Your International Transfers

If you send money from a stronger currency to a weaker one, devaluation might work in your favor. Your recipient could receive more in their local currency because the exchange rate has shifted upward.

But if you earn in a weaker currency and send to a stronger one, devaluation makes things harder. You’ll need to spend more of your local money to match the same dollar or euro amount. For instance, if you send $1,000 USD to Nigeria and the exchange rate shifts from ₦1,200 to ₦1,500 per dollar, your recipient gets ₦1,500,000 instead of ₦1,200,000. That’s the upside of devaluation when sending from a stronger currency

But if you reverse the situation, you will be affected. Assuming you are sending money from Nigeria to the US, it suddenly costs you more naira for the same amount.

Real World Example

Imagine you are a freelancer in Canada who supports your family back home in Nigeria. If the naira gets devalued, the same $500 CAD you send will now convert to more naira. Your family receives more in local terms, but the purchasing power may not rise equally. The reason is that goods and services also become more expensive after devaluation.

So, while exchange rates may look better on paper, inflation often catches up. In essence, it neutralizes the advantage.

The Hidden Side Of Devaluation: Inflation

Devaluation and inflation often go hand-in-hand. When a currency weakens, imported goods cost more. Fuel, food, and basic items also rise in price. So even though your recipient might get more money, there’s a negative effect. The real value, what they can buy with it, may not increase much.

This is why understanding devaluation is very important. It’s about how far your money actually goes once it arrives.

How To Protect Your Transfers From Devaluation

You can’t control currency markets, but you can plan around them:

- Monitor exchange rates. Keep an eye on trends using real-time converters. This will let you know when to send money at the right time.

- Send money regularly. Smaller, frequent transfers can reduce timing risk.

- Diversify your accounts. Hold money in stronger or more stable currencies when possible. For example, a person living in Nigeria could try and hold some dollars instead of keeping all their money in naira.

- Use transparent transfer platforms. Always check the rate before confirming your transaction.

The Role Of Remittance Services

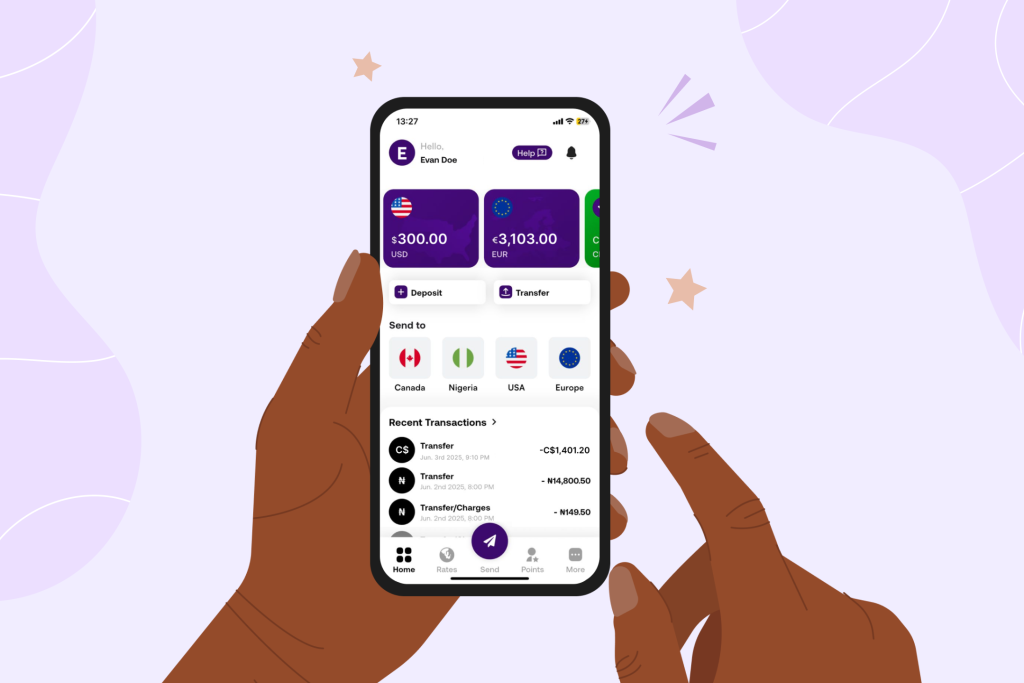

Not many cross-border payment services handle devaluation the same way. Some charge hidden fees or delay updating rates. However, CadRemit offers live market rates and full transparency, so you always know exactly what your recipient will receive.

Every change in exchange rates affects how much you send back home, but using CadRemit can help you keep more of your money’s real value.